Ten Ways to Run Out of Money Part 3

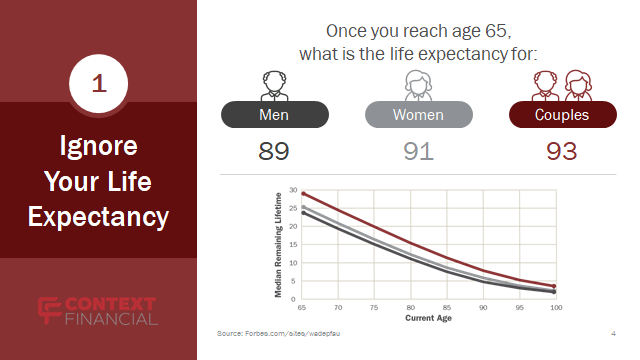

I’m pretty sure this one is directly related to the first issue, life expectancy. And the assumption that there is no way you will live to see the market recover from a downturn or a crash. This is more of the assumption that the present moment is all there is. Things won’t change from “this”, whatever “this” is.

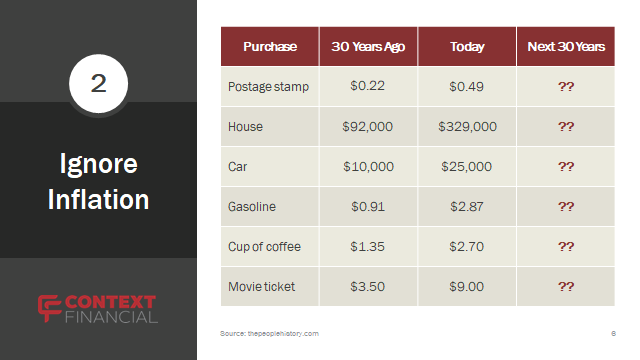

So, here are some numbers in a nice chart:

Read More