Ten Ways to Run Out of Money Part 2

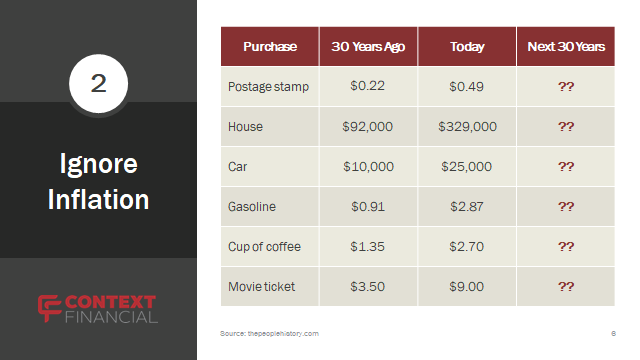

This is a tricky issue because the change isn’t very big in any given year. The long term average for inflation is 3.25%. That’s averaged out from 1913 to April of this year. If we refer back to the previous discussion of life expectancy, it starts to make sense. Over a single year, the cost of the car only goes up 3.25% or $812, but over 30 years the price goes from $25,000 to $65,259.

So the solution to this problem is:

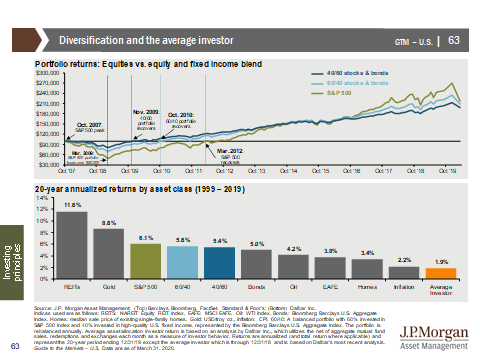

Let’s focus on the bottom part of this chart. It’s showing asset class return and an inflation rate of 2.2% The lesson here is that the only way to beat inflation is to have money in the market. That’s the easiest way to beat the decline in spending power. If you look at the top chart, it’s showing returns for equities (stocks) and fixed income blends. The outcome is in favor of a diversified portfolio.

This lesson ties in with the previous one. Current retirees can often think of the day they quit going to work as “the finish line.” The instinct is to keep the money they have accumulated “safe.” This is perfectly understandable, but it ignores the potential for 35 years of “retirement.” Sitting on the money in cash that long almost ensures problems in the later years.

No Responses