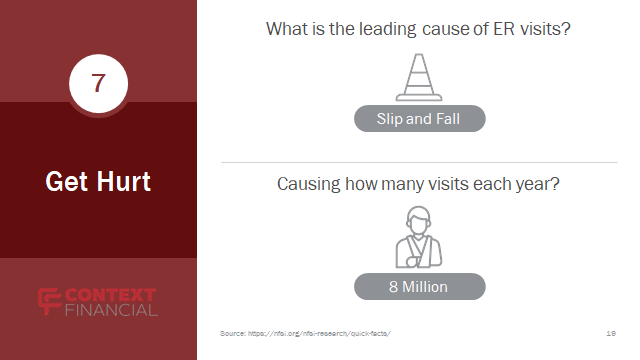

Ten Ways to Run Out of Money Part 7

- Whatever size your home, let’s go to #7, getting hurt

- Who has a close friend or family member who experienced a crippling injury?

- Luckiest client ever, had a client fall from the top of the ladder, only bruises

- LUCK FAVORS THE PREPARED!