Ten Ways to Run Out of Money Part 5

This is a scary one. It’s scary because it threatens our self image. “How could I fall for that?” Unlike identity theft which has protections built in, there really aren’t any protections with scams. Apparently the Nigerian Prince is not coming to Bluegrass Field to drop off my inheritance. Which is sad.

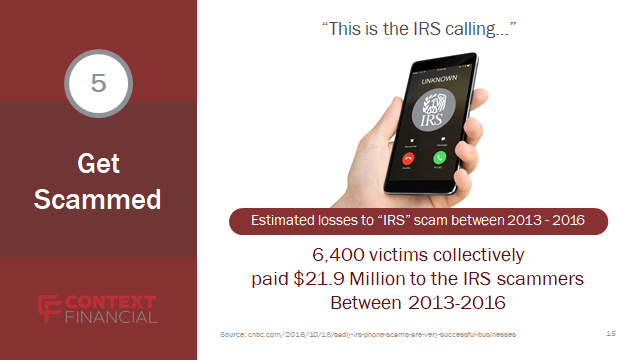

The math in the image above works out to $3,421 per victim. That isn’t a whole lot of money per victim. I will bet my now uncertain fortune that those numbers are much higher. Who would really want to come forward with a story like that?

Which leads us to the antidote, and the reason the scam works in the first place. The scam works, at least in part, because the victim feels bad about being scammed. We have to agree that part of our role in your financial life is to answer questions and clarify confusing things. We need to be the safe place you can call and say “I got a call about my Social Security number yesterday. Apparently I’m a wanted fugitive now, got any advice?”

In reality, very few financial issues require immediate response. The organizations that could be asking you for information do not move quickly and they do not require immediate response. That’s part of the con. If the perpetrator can get your fear response to kick in, it literally turns off the higher executive function in your brain. The critical thinking areas turn off and the quick reaction side takes over. The brain uses the same processes it would use if you were living in a cave and worried about the big tiger in the tall grass.

Call us. We’ll talk it through and come up with a strategy to address the threat.

Reach out to your loved ones, they miss you!

No Responses