Bonds, Crypto and a Big Boat

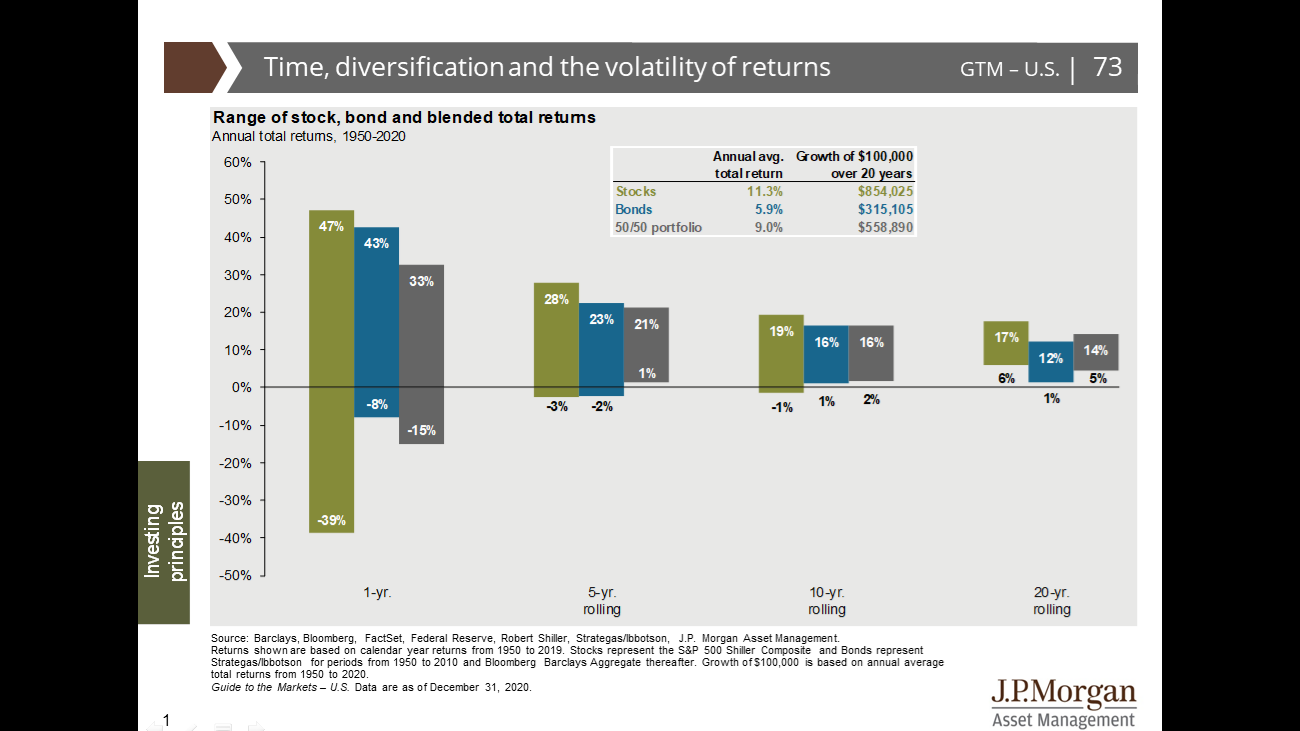

A slightly different format this week. I’ve been reading investment articles, and I thought I’d highlight the parts that interested me. Here is a striking chart from a great article I got from Blackrock. The important lesson here is that very few of our clients actually have the classic 60/40 portfolio. And this chart kind of explains why. With interest rates down around zero for the next year or two, the yield on bonds isn’t going to be anything to brag about. Our Yield model, which would benefit greatly from 14% yield in Treasury bonds, is heavy in dividend paying stocks.

There is still a place for bonds in the portfolio. They are a useful “insurance policy” when the market gets flustered.

Read More