Bonds, Crypto and a Big Boat

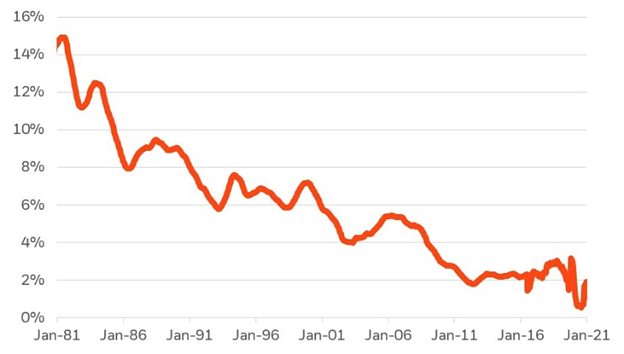

A slightly different format this week. I’ve been reading investment articles, and I thought I’d highlight the parts that interested me. Here is a striking chart from a great article I got from Blackrock. The important lesson here is that very few of our clients actually have the classic 60/40 portfolio. And this chart kind of explains why. With interest rates down around zero for the next year or two, the yield on bonds isn’t going to be anything to brag about. Our Yield model, which would benefit greatly from 14% yield in Treasury bonds, is heavy in dividend paying stocks.

There is still a place for bonds in the portfolio. They are a useful “insurance policy” when the market gets flustered.

A 40-year decline in the 10-year U.S. Treasury yield

The next topic doesn’t actually come from an article. It’s the combination of the experiences of our clients and friends. We’ve had two people reach out in the last two weeks looking for help with Crypto Currency. They had each attempted to convert crypto assets into American cash, and in both cases their money was floating somewhere in the air. I reached out to a few people I know that understand this far better than I do. I was told the chances of recovering the assets were pretty small. The front end of the crypto machine, the part that processes your bank transfer or credit card or whatever has been built out very quickly. The second half of that process, the one that turns Crypto into untold wealth has not been built quite as carefully.

I’m fascinated by the role Crypto plays in the minds and pitches of the advocates. It is at once a path to social justice, a store of wealth in times of inflation, a gateway to a new digital, non hierarchical world, a refuge for the dispossessed around the world, and many other things. What it doesn’t appear to be yet, is a reliable investment. If you have had an experience with Crypto, I’d love to hear about it.

A last thought. I can’t tie this one directly to money (yet). The saga of the Ever Given, the ship stuck in the Suez Canal was fascinating. There are a bunch of interesting lessons in this story. Here’s the one I think is probably a Financial Life Planning lesson. The Ever Given is wider than other ships. She carries more rows of containers than most other container ships. This extra width adds some seconds to each time the crane picks up or puts down a container. The crane hook has to go farther each time. The additional trip is an extra 10 seconds, but that 10 seconds is added to 40,000 containers. That’s an extra 100 plus hours to unload and load the ship. There’s got to be a lesson for us here somewhere.

No Responses