Business Exit Planning: Valuation, Deal Structure, and Timeline for Founders – Context Financial

Business Exit Planning: Valuation, Deal Structure, and Timeline for Founders – Context Financial

How to Prepare a Business for Sale and Maximize Net Proceeds

If you are a founder considering an exit, you already know the headline number is not the full story.

The win comes from preparation that raises your valuation multiple, a deal structure that protects your downside, and a clear target for post-sale life.

“Most business owners base their exit on hope. Hope is not a strategy. Use numbers and set a target.” ~ Josh Ackerman, Certified Financial Planner™

In my conversations with investment banker Geoff Eliason of SDR Ventures, we dug into how owners can control the controllables and sell on their terms.

Business Valuation Multiples and EBITDA Explained

What really drives your multiple

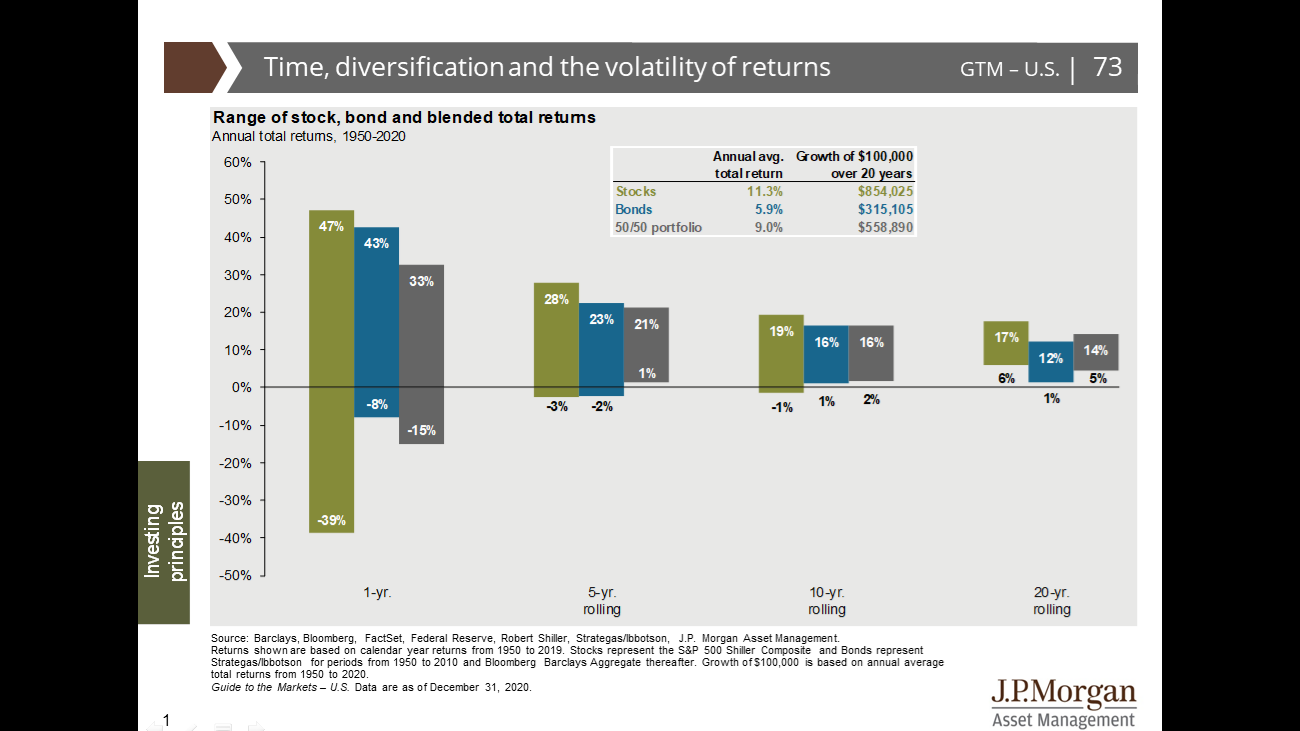

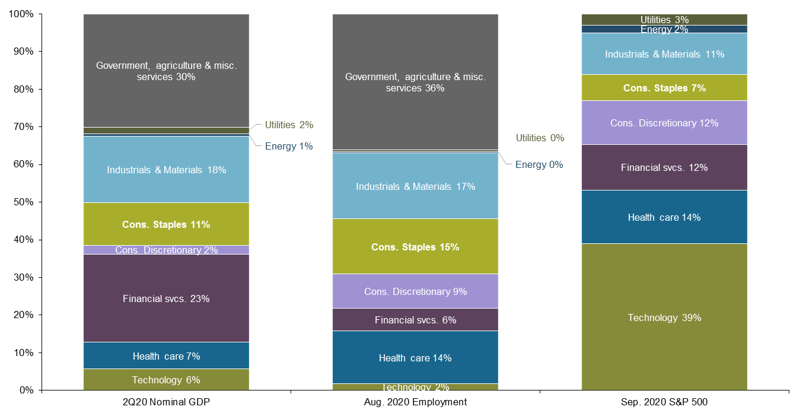

Buyers pay for durable, transferable cash flow. They reward clean books, consistent EBITDA, customer diversification, and a management team that can run without you.

Work toward stable year-over-year earnings and reduce single points of failure in customers, suppliers, and key people.

Industry comps vs actual buyer demand

Comps are a starting point. Real buyer demand, competitive tension, and your readiness package influence where you land within a range.

A quality of earnings review, forecast with defensible growth drivers, and a prepared data room help move you from “average” to “premium.”

Build an Exit Plan That Maximizes Net Proceeds A clear target number, better EBITDA, smarter terms. |

Why net proceeds beat headline price

Sellers fixate on the headline purchase price. I focus you on net proceeds at close. Taxes, working-capital pegs, escrow, seller notes, earnouts, and fees all affect what you actually take home. There are 33 million small businesses in the U.S., and every exit is unique; you need a plan built for your facts, not a neighbor’s deal.

YouTube Shorts |

Deal Structures: Cash at Close, Earnouts, and Rollover Equity

Deal terms change your outcome more than most sellers expect. Here is a quick reference you can use to frame options before you negotiate.

Deal Structure Cheat Sheet

Element | What it means | When it helps you |

Cash at close | Wire to you at closing | Certainty now and simpler planning |

Earnout | Future payments tied to performance | If growth is likely and metrics are clear |

Rollover equity | You keep a minority stake in NewCo | If you trust the sponsor and want a second bite |

Seller note | You finance part of the price | If it boosts total price with acceptable risk |

Employment/consulting | Paid role after close | Smooth transition, protects relationships |

Exit timeline and succession planning for family businesses

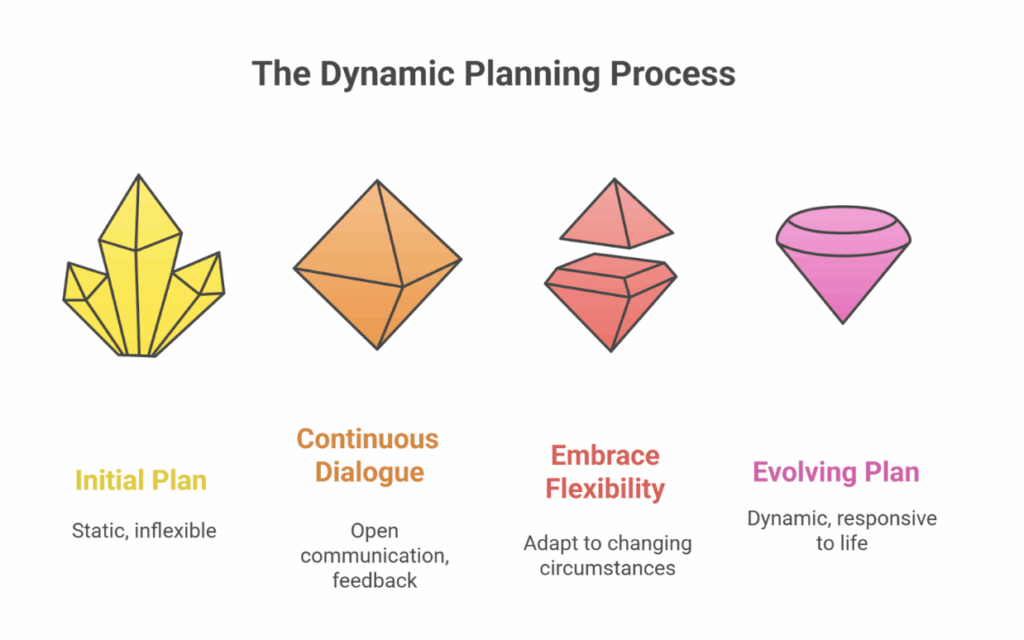

Many founders wait too long to decide between internal succession and a market sale. By the time they call an investment banker, the clock reads eleven, not eight. My guidance is simple.

- One year before market: Lock your target number, complete a readiness review, tighten financials, and run a quality of earnings.

- Six to twelve months to sell: Market the company, create buyer competition, negotiate terms, and sign an LOI.

- One to five years post-close: Many deals require you to stay involved for a transition or earnout. Know yourself if you are chronically unemployable, structure accordingly.

Family dynamics add complexity. If one child runs the business and the others do not, fairness and equality are different concepts.

Consider trusts, governance, buy-sell mechanics, and liquidity paths for non-operating heirs. Start these conversations early so holidays stay friendly.

Related Readings |

According to the Exit Planning Institute, up to 75% of owners regret selling within 12 months because they lacked a personal and financial plan for life after the deal. Align the exit with your values and your next chapter to avoid that outcome.

Ready for your next chapter

An exceptional exit is built, not found. Get your numbers right, improve what drives your multiple, and negotiate for net proceeds that match your life’s goals. Then design the personal side so you do not wake up after closing, wondering what to do next.

If you want a thinking partner to map valuation, deal structure, and post-sale planning into a single path, contact us, and let’s get started.