A Journey into Financial Planning for Business Owners – Context Financial

From Printers to People: How One Conversation Changed a Career

In a world where careers often unfold by default, I discovered my calling in financial planning for business owners during a simple lunch with my dad.

That conversation sparked a career devoted to helping families, entrepreneurs, and business owners navigate money with purpose and clarity.

“I realized I needed to be doing something that had a more positive influence on the world than selling printers.” ~ Josh Ackerman, Certified Financial Planner™

The Spark That Started it All

My path into values-based financial planning began with dissatisfaction.

I was working in corporate sales and realized I wanted to build something meaningful. My father, who had spent his career in financial services, reminded me that true fulfillment comes from helping others succeed.

By that Friday afternoon, I had closed one last deal and signed up for my first Certified Financial Planner course. What began as curiosity became a lifelong commitment to succession planning and long-term relationships with family-owned businesses.

YouTube Shorts |

Why Fit Matters More Than Sales

In financial services, chemistry and trust are everything. I’ve learned that if a client and I don’t connect, the best outcome is to part amicably.

“If you and I don’t connect, the worst thing I could do is convince you to work with me anyway.”

That belief has shaped how I approach every relationship at Context Financial. I focus on transparency, building trust, and ensuring my clients always feel understood.

Discover the Power of Authentic Financial Planning for Business Owners Because your plan should fit your goals, not the other way around. |

Financial Planning is a Verb, Not a Product

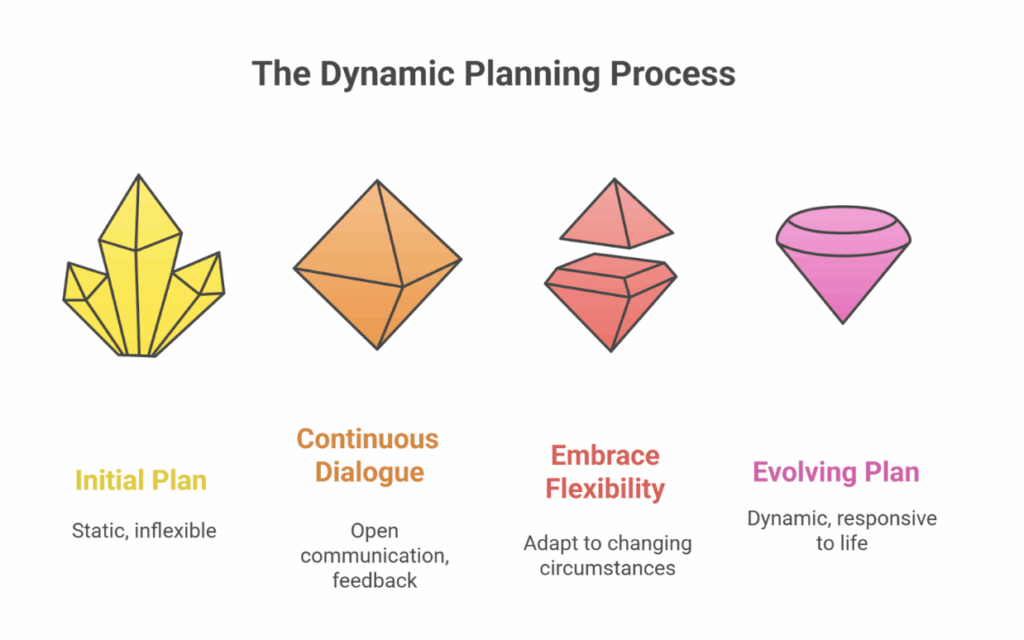

For me, financial planning for entrepreneurs isn’t about selling a one-time plan. It’s about the ongoing planning process.

Building Trust Through Process

True planning evolves as life does. It requires ongoing communication and adaptation, especially during moments of change such as retirement, business succession, or family transitions.

Speaking Financial

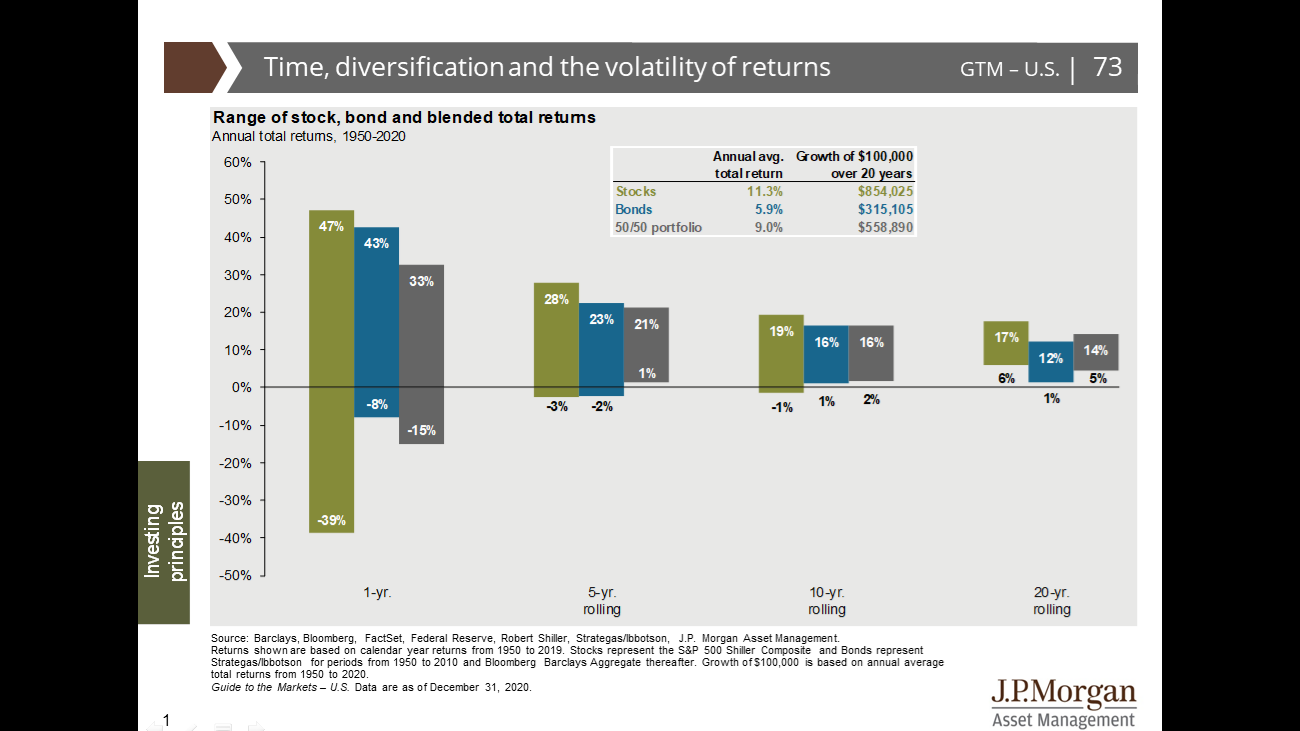

I often say, “I speak financial.” My mission is to translate complex financial language into something everyone can understand.

According to the first-ever S&P Global FinLit Survey, only 57% of U.S. adults are financially literate, underscoring the need for this translation.

Two Mindsets: Scarcity and Abundance

I help clients identify their emotional relationship with money.

By balancing fear and optimism, they learn to create both security and growth. This balance is one of the key ingredients in sustainable succession planning..

Category | Scarcity Mindset | Abundance Mindset |

Core Belief | Money is limited; if someone else gains, I lose. | Money is a tool; success expands when shared. |

Emotional Driver | Fear, anxiety, and control. | Gratitude, optimism, and curiosity. |

Decision Style | Avoids risk and prefers the familiar. | Takes calculated risks and embraces opportunity. |

Focus of Attention | Preservation and protection of what already exists. | Creation, growth, and long-term value. |

View of Others | Competitors who might take what’s mine. | Collaborators who can help everyone succeed. |

Language Patterns | “We can’t afford that.” “What if it runs out?” | “How could we make that work?” “Let’s find a way.” |

Business Behavior | Hoards resources, delays investments, resists delegation. | Reinvests strategically, empowers others, and plans proactively. |

Impact on Relationships | Leads to tension, secrecy, or guilt about money. | Builds trust, openness, and shared financial goals. |

Result Over Time | Stability without progress; missed opportunities. | Sustainable growth, flexibility, and confidence. |

Related Blogs to Explore – Taking a Step Back to Move Forward When Retirement is Around the Corner |

The Human Side of Numbers

I often tell people that financial planning for business owners is “the most liberal arts career ever created.” It blends math, psychology, and communication to help people align money with meaning.

As an educator at the University of Kentucky, I’ve had the privilege of helping shape the next generation of advisors through the Certified Financial Planner program. My teaching philosophy mirrors how I work with clients: relationships first, numbers second.

A recent CFP Board study found that 93% of advisors say their work provides personal fulfillment because it improves clients’ lives; a truth I embody daily.

Moving from Transaction to Transformation

What began as a career pivot from printers to people has grown into a mission to guide family business transitions and personal wealth planning with empathy, clarity, and trust.

Success, for me, isn’t measured in assets. It’s measured in confidence. My goal is simple: to help every client see the full picture of their financial future and prepare emotionally for what’s next.

If you’re a business owner thinking about your next chapter, start early. Begin by discussing your business exit strategy, goals, and life after the transition.

Ready to explore your next step? Contact us today.