Business Exit Planning: The Stories That Reveal What Most Owners Miss – Context Financial

Succession Planning for Business Owners: What I Learned From Two Hard Truths

Selling a business is not just a financial decision. It is a personal shift that can reshape your identity, your lifestyle, and your relationships.

I spend a lot of time helping owners look past the purchase price and ask better questions before they make a move they cannot take back.

“Who are you going to be when you’re no longer the boss?” ~ Josh Ackerman, Certified Financial Planner™

|

Increase Business Value: Three Drivers Buyers Always Notice

The market will price your business based on what it can reliably produce for the next owner.

That is why I coach clients to prepare early and focus on three drivers that consistently move the needle: financial performance, growth potential, and the Switzerland structure.

Financial Performance: Make it Predictable

Buyers pay for consistent earnings, not sporadic spikes. If your P&L looks choppy, your multiple suffers. Clean books, clear separation of personal and business expenses, and documented recurring revenue build confidence.

According to the Exit Planning Institute, up to 80% of companies put on the market never sell, often due to weak financial readiness and owner dependency. Start fixing that now.

Plan Your Exit with Confidence Clarity on value, timing, and your life after the sale starts with one conversation. |

Growth Potential: Keep Your Foot on the Gas

You may feel like you are at mile 26 of a marathon. The buyer is at mile zero. They are paying for what happens next. Maintain momentum during negotiations.

Keep winning work, documenting the pipeline, and empowering your team.

Businesses that maintain or grow revenue during the sale process typically achieve higher valuations.

The Switzerland Structure: Reduce Single-Point Risk

Avoid overreliance on any one customer, supplier, or employee.

My rule of thumb is that no customer should account for more than about 15% of revenue. Diversification signals resilience and makes the business easier to own and easier to buy.

YouTube Shorts |

Owner Readiness Checklist |

✅ Three to five years of clean, gap-free financials ✅ Documented recurring revenue and retention rates ✅ Written processes for sales, operations, and finance ✅ Customer concentration below 15% per account ✅ Cross-training to reduce key-person risk |

Business Exit Planning: Two Stories Every Owner Should Hear

These conversations are not theoretical. Here are two experiences that shaped how I help owners think about transitions.

Story 1: “A Good Multiple” That Was Not Good Enough

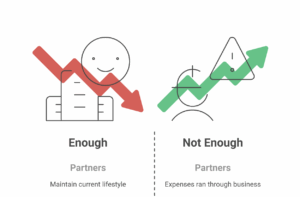

Two partners received an offer. Their advisors focused on tax, legal, and industry multiples. In the parking garage afterward, I asked a different question: “Net of fees and taxes, do you have enough to maintain your current lifestyle?” They did not.

Too many expenses ran through the business, so their “paycheck” was only a fraction of what they truly lived on. They paused the sale, implemented retirement savings, tightened books, and grew earnings.

Five years later, they sold successfully, on purpose rather than under pressure.

Story 2: Retirement Begins on a Tuesday

Another client celebrated a successful exit, completed the earnout, took the dream trip, then came home.

On Tuesday morning, he asked his wife, “What are we doing today?” She said, “I have tennis, a meeting, lunch, then an event. I will see you at dinner.” He realized he had built his entire social world around work. If you do not plan your next identity, you risk feeling unmoored.

This is one reason why research commonly cited by EPI notes that a majority of owners regret selling within 12 months. The math often works. The life plan does not, unless you design it.

Related Blogs to Explore – Smart Strategies for Passing Down the Family Farm – Navigating Family Business Transitions: Why Context Financial Stands Out |

Family Business Succession Planning: Fair is Not Always Equal

Transitions within a family introduce a different level of complexity. One common mistake is assuming equal shares are automatically fair.

If one child runs the company full-time and the others do not, equal ownership can stall decisions and starve the operator of resources. Plan for cash flow needs across generations before you hand over the keys.

Table: Fair vs Equal in Family Business Transitions

Issue | “Equal” Outcome | “Fair” Outcome | Why It Matters |

Ownership split | 25% each to four siblings | 51% to active operator, remaining held in trust or paid out over time | Decision-making aligns with accountability |

Cash flow after transfer | Retired parent draws high salary, operator takes what is left | Parent funded by separate assets, operator earns market comp | Prevents starving the business |

Exit for inactive heirs | No plan, pressure to sell | Predefined buyout formula, discounts, and timeline | Reduces conflict and protects continuity |

What To Do Next

Start early. Ask better questions. Build a business that is valuable to a buyer and a life that is valuable to you.

Clean up your financials, keep growth moving, reduce concentration risk, and design your post-transaction identity with the same rigor you used to build your company.

The Small Business Administration notes that nearly half of business owners are 55 or older, which means timing and preparation are now strategic advantages.

When you are ready to explore business exit planning or succession planning for business owners in a way that fits both your numbers and your life, contact us to start the conversation today.